November 2018

In a first for the employee benefits (EB) sector, GEB is deploying Blockchain technology in a mode that is set to change the way the industry works forever. It promises a perfect alignment of objectives – in terms of process, data quality, security and transparency – across all parties involved in the ecosystem: the GEB Network, local insurers, intermediaries and multinational clients.

In October 2018, GEB officially moved its Blockchain project into a prototyping environment, supported by the Generali Group and inspired by B3i, a collaborative initiative of 15 global insurers and reinsurers who came together in late 2016 to explore and test the potential of Blockchain in the industry (www.b3i.tech).

“The idea for the prototype was initiated by GEB as part of this consortium,” says Fabiano Rossetto, GEB Chief Process Officer. “We wanted to truly innovate and disrupt the EB market: to offer smart, reliable, secure and meaningful solutions to all our stakeholders.”

As part of the prototype, GEB is driving the adoption of the Blockchain, working in partnership with two global clients and local insurers across three countries representing different lines of risk, sizes and market maturity stages: in other words, a clear representative of the GEB Network.

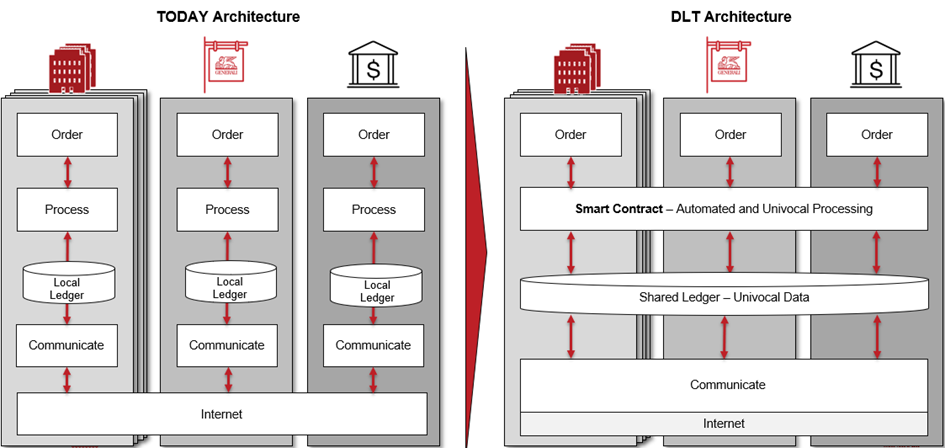

“The goal is to adopt Blockchain - a specific type of Distributed Ledger Technology (DLT) - to engage all parties in improving our business model: namely starting from the insurance to captive process,” explains Alberto Branchesi, Head of Data and Digital Platforms at Assicurazioni Generali. “This in turn will help save time, cut costs, reduce risk, increase trust and improve data quality.”

We have already observed these types of initiatives in the non-life P&C space, and also in the banking industry where the level of standardisation and automation is more mature if compared with the insurance sector.

However, the application of Blockchain technology to the EB arena has not been tackled: it was, until now, considered almost impossible. This is because insurers work in such very different ways, facing lack of standards, no shared data governance and therefore with costly custom interconnectivity between the ecosystem’s players, (with a myriad of different local definitions of policy and risk coverage, just to mention one example).

How can GEB make the impossible possible?

GEB is perfectly positioned to act as a Blockchain pioneer and to drive this innovation. In fact the underlying technological solution and GEB’s business model represent an ideal match. Blockchain enables the complex network of players to exchange different assets (such as data, information or, in our case, EB risks) in a secured way, reducing costs and increasing trust.

“This is exactly how the GEB Network is structured,” adds Fabiano. “We work across borders and we’re in the business of collecting, validating, aggregating data in a way that serves the client. Our ecosystem encompasses local partner insurers and clients and every relationship is managed by a contractual agreement, which is the reinsurance treaty. Thanks to this we can process information, govern the Network and transfer the risk to the captive reinsurer.”

These treaties can be converted into what is known in the technological terms of Blockchain as ‘Smart Contracts’. All parties will be involved in agreeing how the Smart Contracts are designed and how they will behave. Under GEB leadership, the project is effectively a co-creation exercise to determine which are the critical points to be addressed by this DLT technology that will enable this new way of working. It is a huge process transformation with benefits shared by all the stakeholders involved.

Andrea Pontoni, GEB Chief Operating Officer, commented “The use of this technology eliminates the need for a central authority or intermediary to process, validate or authenticate data exchanges. Instead, data is spread across multiple sites, regions or participants and only ever stored in a ledger – or database – when consensus is reached by all parties involved”.

“This technology enables the stakeholders of the reinsurance to captive process to share and synchronise both contractual agreements (reinsurance and cession treaties translated into “Smart Contracts”) and underlying data without establishment of a centralised platform and database, keeping data ownership at local level”.

The benefits for GEB’s reinsurance processes

Some of the benefits of Blockchain in the EB space can be summarised as follows:

- Greater transparency – sharing the same ledger between all parties will facilitate and increase data quality thanks to the transparency of any transaction and data transformation. Everything is archived and authorised in a decentralised system and platform to ensure that data is processed in a reliable and transparent way

- A move away from batch executions – at present, the business model is bound to fixed deadlines as everything is done quarterly with a number of delays after the closing of the quarter. The project goal is to create a reliable platform, agile and independent of the frequency, allowing GEB and partners to move away from batch executions.

- Elimination of human errors – Blockchain will remove the need for constant manual interventions, thus eliminating multiple reworks of the same data set and reducing to zero human errors.

- Increased efficiency and speed - today, reconciliations and settlements are done by different departments using different technologies, potentially introducing time shift and accounting issues. With Blockchain, accounts payable are automatically shared between the involved parties, enabling cascading to the Treasury and Banks with no manual intervention required.

This list cannot be considered exhaustive since we are only at the begin of a journey. Today we cannot even imagine the entire transformational impact on the existing business model and how many radical new business models this technology will unlock.

What does success look like?

As mentioned earlier, the key issue in the EB space is that every insurance company works in a different way. To overcome this challenge, GEB drives Network partners and clients to a place where will be standardisation and integration with a clear final goal of process automatization.

By 2019, we expect the prototype to be fully up and running. The next step is to identify convergence within the B3i roadmap and progressively get onboard all Network Partners to further grow and expand into the production environment.