Even in a challenging environment, our Group continued to drive profitable growth and create sustainable value for all stakeholders, delivered by all Generali People and agents.

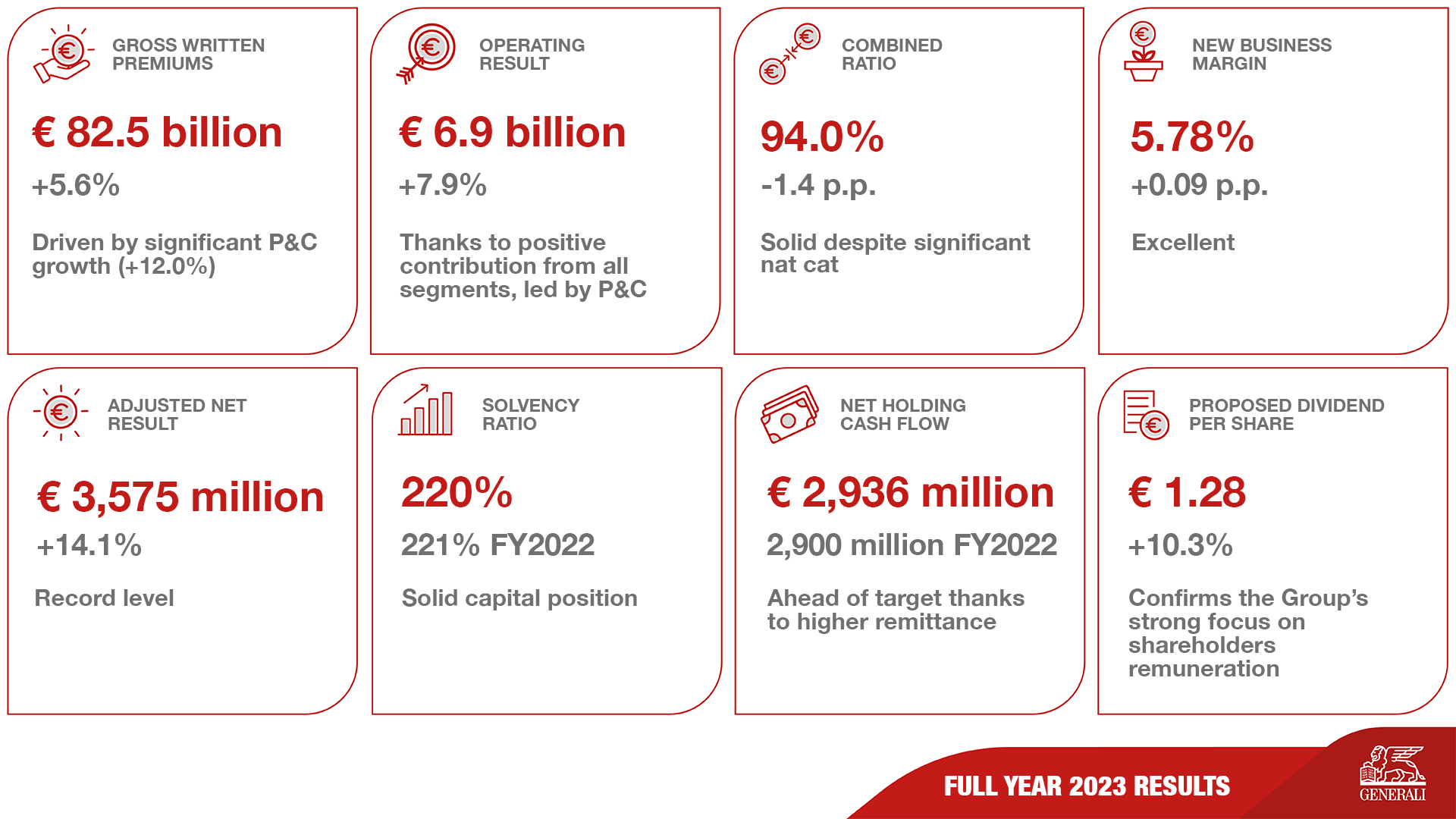

- Gross written premiums increased to € 82.5 billion (+5.6%), driven by significant P&C growth (+12.0%). Life net inflows entirely focused on unit-linked and protection, consistent with the Group’s strategy

- Record operating result at € 6.9 billion (+7.9%), thanks to a positive contribution from all segments, led by P&C. The Combined Ratio improved to 94.0% (-1.4 p.p.). Excellent New Business Margin at 5.78% (+0.09 p.p.)

- Record adjusted net result at € 3,575 million (+14.1%)

Solid capital position, with the Solvency Ratio at 220% (221% FY2022), thanks to the strong contribution from normalised capital generation - Proposed dividend per share of € 1.28 (+10.3%) confirms the Group’s strong focus on shareholders remuneration and achieves the 2022-2024 cumulative dividend target

Generali Group CEO, Philippe Donnet, said: “Generali’s strong performance in 2023, underpinned by a record in operating and net result with the positive contribution of all segments, demonstrates the successful execution of our ‘Lifetime Partner 24: Driving Growth’ strategy. Thanks to our strong cash and capital position we are accelerating the growth of dividends for our shareholders. The Group is in the best shape it has ever been as a profitable, diversified Insurance and Asset Management player. Generali’s future success will also benefit from the acquisitions of Conning and Liberty Seguros. I would like to take this opportunity to thank all our colleagues and agents for their efforts to achieve these very positive results. They are the foundation of our sustainable growth journey and of our commitment to act as a responsible investor, insurer, employer and corporate citizen.”

Discover more in the full press release.